10 years ago this month, I opened up my laptop on the desk underneath my dorm loft bed and bought the domain collegeinfogeek.com. This means that this month marks a full decade as a content creator and entrepreneur.

During that decade, I’ve watched the content landscape change radically.

The growth of YouTube, podcast hosting, and platforms for the written word like Medium and Substack has made it possible for more people than ever to make a living creating content.

The existence of algorithms that boost content – particularly on YouTube and TikTok – means creators can go from hobbyists to professionals virtually overnight in some cases.

So, today, I want to share some of the lessons I’ve learned during my 10-year journey as a content creator and entrepreneur. Each of these five lessons is something I wish I’d known when I got started. If you’re a creator yourself, or have ambitions to become one, I hope these lessons will be useful for you as well.

Your Best Friends are Deadlines and Accountability

Running my own company means that I am my own boss. This is awesome for many reasons; I set my own hours, there’s no corporate policy that tells me I can’t install Evernote on my computer, and I can empty the coffeepot without making a new one and get away with it.

But when I started working for myself, I lost all of the structure and constraints that took for granted in school, in my internship, and in all my part-time jobs. School and work always came with deadlines and oversight, and while these things could feel stifling at times, they were also quite useful; they created pressure that forced me to get my work done on time.

As an entrepreneur, everything is on me – and my self-discipline is not always up to the task of reigning in my brain’s more impulsive, “System 1” tendencies.

Daniel Kahneman’s book Thinking, Fast and Slow introduces two different “systems” in the brain: System 1 and System 2.

System 1 is the largely subconscious, impulsive, and reactive system. It does all the “fast” thinking; when you have an involuntary reaction to a bee buzzing near your ear, turn your head as you hear your name over the conversations at a party, or instinctively reach for your phone to check a notification, that’s System 1 at work.

This system also handles automated process, like driving on an empty highway or reading simple sentences.

System 2, by contrast, is the “slow” system. This system handles effortful, voluntary thinking. When you work to solve a math problem, play a difficult piece on the guitar, or try to resist checking that notification on your phone, you’re utilizing System 2.

When talking about self-management, we can think of System 1 as the horse and System 2 as the rider; the latter has a limited ability to control the former. However, System 1 is still a 1,200-pound horse, and it can be hard to control.

The deadlines, timetables, and authority figures that populate schools and companies are all examples of external systems that lend System 2 a helping hand in guiding System 1 – and without them, it will inevitably fail more often.

I’ve learned this the hard way more than once. In 2012, my blog started gaining some real traction and I started earning enough passive income from a few of my articles to pay my bills. Then, in 2013, I made the fatal mistake of getting into Magic: The Gathering – and I ended up spending much of that year doing very little to grow my business.

I’d wake up each day intending to write a new article or code a new feature for my site, but then I’d inevitably get distracted researching card combos or building new decks. Without any real deadlines, a boss, or a pressing need to bring in money right now, I found myself controlled by the whims of System 1 – and it was much more interested in building a new Commander deck than in starting the difficult task of writing an article.

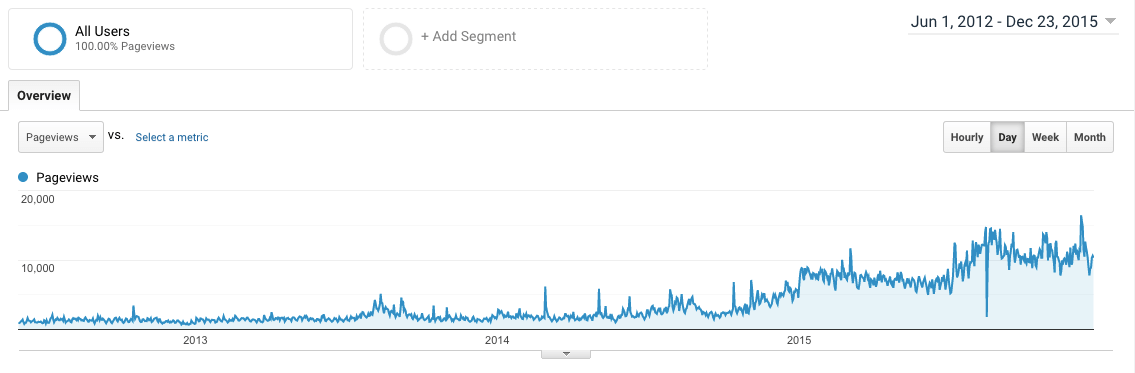

This pattern continued for quite some time; if you look at my website’s analytics from that time, you’ll see a long period of stagnation:

However, you see something else as well. In mid-2014, things finally start to move upwards, leading up to a big increase in average daily visitors starting in 2015.

Mid-2014 was when I decided to start acting like a professional. As my friend James Clear put it:

“Amateurs wait until they feel inspired to do creative work. Professionals do it on a strict schedule.”

Up until this point, I had been working like an amateur. I wrote when I felt like it. But to get to the next level – and to break through my period of stagnation – I needed to go pro.

The first step to doing that was putting myself on a publishing schedule that had real consequences for failure – just like I would have had if I was working a regular job.

A huge inspiration for me was reading Nick Winter’s book The Motivation Hacker, in which he details his experience attempting a ton of difficult challenges over a three-month period. Among others, these included writing the book itself (in three months) and getting over his fear of skydiving.

For each of these challenges, Nick used a tool called Beeminder that tracks your goals and charges real money if you fail. Not one for dipping a toe to test the waters, Nick went all-in and put more than $14,000 on the line to ensure he’d accomplish both of these goals – which, naturally, he did.

I was not willing to bet that much money (nor did I have that much at the time), but I created my own Beeminder account, hooked it up to my blog’s RSS feed, and put myself on a professional’s schedule: Each week, I’d publish one blog post, one podcast episode, and one video for my YouTube channel.

Now I had deadlines – and a tool that held me accountable to those deadlines. I had those all-important external systems pushing me to publish, and publish I did.

I also started writing a book a few months later – something I’d failed to do multiple times before. This time, I used Habitica to track a daily word-count goal. Within three months, my book was done.

The lesson is clear: If you’re going to work for yourself, act like a professional. Make the executive decision to add some kind of external commitment device that helps you stay on task. Remember Parkinson’s Law:

Work expands so as to fill the time available for its completion.

Reach Out and Build Relationships

Working for yourself – and by yourself – can get lonely. Often, if you’re running your own business, your IRL friends do not understand what you do or why you feel compelled to stay up until 4:00am tweaking button colors on your website.

I know this was the case for me. I had a great group of friends when I started my business, but all of them were still in college at the time. They were concerned with grades, finding a job after graduation, and being angry at Mass Effect 3’s ending.

This is only one of the reasons that the relationships I’ve built with other entrepreneurs and content creators have been so valuable.

When I started out, I didn’t have anyone to talk to about SEO, web design, habit trackers, typography, or any of the other nerdy stuff I was into. Mostly my friend just made fun of me (in a good-natured way) for spending all of my free time writing articles instead of playing video games with them.

Once I started reaching out to my contemporaries, however, that all changed. Though I was still isolated geographically, I started to gain a network of friends who shared my passions.

People like Pat Flynn, Matt Giovanisci, Andrew Fiebert, Jenny Blake, and Steve Kamb have all become friends of mine, and we all share the common bond of entrepreneurship. Additionally, we’ve all had opportunities to help each other, promote each other’s work, and provide feedback.

My only regrets are:

- Not reaching out sooner

- Continually giving into my fear that reaching out would “bother” someone

I’d like to talk about that second regret for a second, as it’s something I deal with even today. I’ll often start following someone whose work I really admire, and want to reach out – but hesitate because I feel like I’m “not impressive enough” yet.

I’d feel like I needed to get to a certain follower count, or write more articles on a certain topic, before I’d be “worth someone’s time”.

I’ll be honest: There is an element of truth to this. When you want to connect with someone who has a large following, you have to be aware that many other people are trying to connect with that person as well. (Can you imagine how many emails and tweets Gary Vaynerchuk gets each day?)

Naturally, if there’s something that makes you stand out, then that person may be more likely to take interest when you reach out. This is simply how human brains work. We’re wired to pick out interesting (or threatening) in a noisy, complex environment.

This means there is merit in the idea that you should be “ready” before reaching out to a person you admire… if you’re making a pitch. When you pitch something, you’re creating a transactional interaction.

This isn’t a bad thing – much of the world runs on transactional interactions! For example, when a potential sponsor reaches out to me, they’re not reaching out because they want to be friends. They’re doing so because they have marketing dollars to spend, and I have a platform that could help them drive additional sales.

But you can’t pretend that a pitch isn’t a pitch. And when you’re making a pitch, then you want to make sure the thing you’re offering is going to interest the other party. In these instances, it may be worth waiting to reach out until you’re “ready”.

However, not every interaction is transactional.

You don’t have to be “ready” to email a creator that you admire to tell them that an article they wrote really resonated with you.

You don’t have to be “ready” to share someone’s work to your followers.

You don’t have to “ready” to respond to tweet with your own thoughts (My first interactions with many of my entrepreneur friends happened on Twitter.)

I call this the fan-first approach. When you admire someone, a great way to start building a relationship is simply to be a fan – share their work, give feedback, interact.

Later, if you see an organic way to further the relationship, take it.

For just one example, I followed and interacted casually with Steve Kamb for a few years online before meeting him in person at a conference called World Domination Summit. After that, we started to become closer friends.

One last thing I’ll mention is that it’s a good idea to seek connections beyond the people who already have a large following. If you attend a conference, make it a point to introduce yourself to a few other attendees. Strike up conversations – after all, if they’re attending the same conference you are, then you both likely share some of the same goals and interests.

You can also seek out like-minded people in online communities for entrepreneurs and content creators. Communities like Fizzle and the r/Entrepreneur subreddit are great places to meet like-minded people.

Know the Taxes You Have to Pay

I had a very rude awakening during the 2013 holidays. I was visiting my girlfriend’s family for Christmas, and her uncle (a financial advisor) and I somehow got on the topic of taxes. I’m not sure how we got there, but I remember myself saying something along these lines:

“Being an entrepreneur is great! It’s awesome that self-employment tax is actually lower than regular income tax!”

If you know anything about taxes, you probably winced just now. Yes, I did believe that self-employment tax replaced income tax for self-employed people… and no, that’s not true at all.

My girlfriend’s uncle helpfully informed me that self-employment tax is something you must pay on top of income tax. When I heard that, my stomach dropped.

I spent some time running the numbers on my mistake and realized that I owed about $30,000 in additional taxes… all due by April 15. Over the next few months, I had to scramble to get all of that paid on time in addition the the next quarter’s estimates.

It was a rough time, and it could have been entirely avoided if I’d been better informed about the taxes I needed to pay. So please learn from my mistake; if you’re going to work for yourself, make sure you know what you owe to the government.

Honestly, it would have been really nice to have learned this in school, especially since about 16 million people in the U.S. alone are self-employed, and that number will only go up in the future.

Sadly, my school did not teach me anything about taxes – and it’s hard to point to a be-all, end-all guide that will fit everything, especially since taxes in the U.S. are purposely complicated.

I’ll try to break the basics down briefly, though.

Let’s say you’ve started a freelance business doing web design, video editing, or one of the many other things my team at CIG has listed in this article on online jobs.

Let’s also assume you’re a single taxpayer living in the United States. If you’re married, things change a bit. If you’re just dating someone, you’re still a “single” taxpayer.

As a newly self-employed person, here’s a breakdown of the taxes you likely need to pay on your income:

- Federal income tax

- State income tax (unless you live in a state that doesn’t have it, like Nevada or Washington)

- Self-employment tax

There may be others: property taxes if you own a home, capital gains tax if you sell investments at a profit, etc.

Of these “big three”, self-employment tax seems to trip people up the most. So… what is it?

Essentially, self-employment tax is the same thing as the FICA (Social Security and Medicare) taxes you pay as an employee of a company. When you’re a regular employee, you typically pay about 7.65% of your earnings in FICA taxes.

However, your employer also has to pay around 7.65% of your earnings in FICA taxes; this is money that is not part of your gross salary, but it’s an additional expense your employer has to pay for the privilege of employing you.

When you’re self-employed, you have to pay both sides of this tax. After all, you’re your own employer! This means that, as a self-employed person, you’re typically going to pay 15.3% of your income in self-employment tax.

Bottom line: When you’re employed, they’re called FICA taxes. When you’re self-employed, they’re called self-employment taxes, and you pay twice as much.

Before you cry, “Not fair!” though, remember: When you’re employed, your employer has to pay that other 7.65%! That means they have to factor that into your salary, which is set lower as a result. What you’re paid and what you cost your employer are two very different numbers.

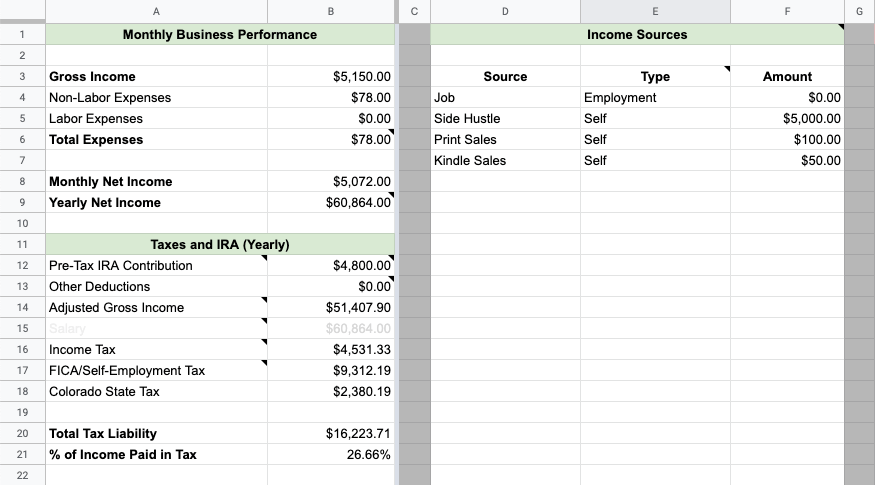

Anyway, here’s a quick example to show you how this all breaks down:

Here we have a situation where you’ve quit your job and are working for yourself full-time. You’re making $5,150/mo on average in gross revenue, and you have $78/mo in total business expenses, meaning you’re raking in $5,072/mo in net profit. Pretty sweet!

If you keep reading down the first column, you can see you’re contributing $4,800/yr to a pre-tax IRA (I’ll talk about IRAs in a future post), which takes your Adjusted Gross Income for the year down to $51,407.

Out of this, your federal income, state income, and FICA taxes are taken out, totaling $16,223.71 – about 26.6% of your income.

If you’d like to input your own numbers, here’s my budget modeler spreadsheet template. This is what I use to forecast my financial future. Make a copy of it and play around with it.

Keep in mind that it’s not a panacea, and that there may be other taxes you’ll have to pay depending on the type of business you run.

For instance, my fiancé sells art prints, buttons, and other physical goods at conventions all around the country. Since she’s selling thing directly, she has to collect and pay sales tax on those goods.

Bottom line: Whatever type of business you’re starting, understand what taxes you have to pay.

Additionally, I’ll echo a tip I got from my friend Pat Flynn; whenever income comes in, set half of it aside in a savings account for tax time.

You probably won’t end up paying half of your income in taxes, but this rule virtually guarantees you’ll have money in the bank if you, oh, I don’t know…. make a $30,000 tax mistake?

Get a Lawyer and an Accountant

Even if you’re a “solopreneur” traveling the dusty roads of the internet with nothing but a sun-faded Stetson and an Adobe suite subscription, content to DIY everything, it’s still worth putting together a “team” that consists of a laywer and an accountant.

It is possible to get by without either of these, especially when you’re just starting out. Sites like LegalZoom can help you do things like setting up an LLC or figure out if you need a business license, and tools like TurboTax can help you figure out taxes when you’re self-employed.

It’s also possible to build a table with a screwdriver, rather than a power drill. That doesn’t mean you should do it. Even if you wait years to delegate other work, I highly recommend building a relationship with a good lawyer and a good accountant early on.

For the first few years I was an entrepreneur, I was afraid that hiring these people would be prohibitively expensive – so I just never reached out to either. I tried to do everything myself.

And, it must be said, there was some good in that. I did learn how to do my own taxes, albeit through TurboTax. I did end up reading through a lot of the legal business requirements for my state and city on my own, and I’ve developed a pretty wide array of knowledge for running my own business.

However… having a good accountant and lawyer on your side is really, REALLY helpful. There’s only so much that Googling around can do, and you can sometimes land yourself in trouble because you miss something important.

Case in point: my $30,000 tax mistake I talked about earlier.

I was very lucky that my fiancé’s uncle caught my mistake in a casual Christmas-dinner conversation. Had he not, I could have easily dug myself into an even deeper hole.

As the old saying goes:

“Nothing is more expensive than a cheap lawyer.”

The same goes for accountants. And, make no mistake, when you convince yourself that you can handle everything by reading NOLO articles, you’re “hiring” a very cheap lawyer/accountant.

Plus, the basic services that accountants and lawyers offer typically aren’t that expensive.

The lawyer I hired when I lived in Iowa charged around $350 (flat rate) to set up my LLC and file all the necessary paperwork with the state. My current lawyer here in Colorado charges me $50 a year for registered agent services, and for filing my annual LLC compliance paperwork. She doesn’t even charge me hourly for simple questions.

When I started working with my accountant, he charged me around $250 each year for tax filing. For that money, he also gave me advice about potential tax breaks and expenses that I could claim to lower my taxable income. Since I didn’t know about many of these, he has actually saved me money.

More importantly, I now have a relationship with each of these people. I still do independent research about a lot of things, but I also have go-to people for law and finance questions that are particularly important. They’re part of my “team” even though I don’t send them regular payments.

So start building your team.

A great way to get accountant and lawyer recommendations is to ask your local entrepreneur community.

In Des Moines, there was one co-working place where many of the city’s entrepreneurs worked. Additionally, there was a weekly entrepreneur meetup I attended called One Million Cups (which runs in many other cities).

I asked around at both of these places, and got recommend a great local lawyer. Matt Giovanisci (who I met through a podcasting conference) recommended my Denver lawyer when I moved here. My accountant came recommended by my fiancé’s uncle (the one who caught my tax blunder).

Building relationships in your community is a great way to get recommendations for professionals who can help you.

One caveat: I do recommend doing your own bookkeeping in the beginning. Software like Xero, Wave (free), and Quickbooks make it fairly easy, and I believe it’s incredibly important for an entrepreneur to have a firm understanding of their business finances. Plus, in my experience, a good accountant will catch bookkeeping errors and help you fix them.

Become an Unprompted Learner

Something I noticed in high school was that a lot of my friends would complain about how much work they had to do to apply for colleges, including:

- Having to search the college website for degree requirements

- Writing essays in applications

- Applying for scholarships

This struck me as odd, because in doing all this work, they were literally signing themselves up to do a lot MORE work. A college application takes a few hours, but it’s signing you up to literally be a full-time student. At the time, it baffled me.

Later on, I came to understand that there’s a difference.

Despite the feeling of freedom that college brings in comparison to high school, part of the allure of going to college is the idea that you’re going to be guided through a structured curriculum that will eventually render you ready for a high-paying job.

College is – or at least purports to be – a guided path. It provides you with a solid set of directions – and most people are willing to work hard as long as you give them a solid set of directions.

Much rarer is the type of person who is willing to do the mental work of figuring out what they need to do in the first place – which explains why my friends complained so much about the college application process.

That’s exactly the kind of person you need to be if you’re going to work for yourself. You have to be willing to Google questions like:

- “What taxes do I have to pay as an entrepreneur?”

- “Do I need a business license?”

- “What’s an LLC?”

…and hundreds or thousands of others.

Being your own boss means being the one who builds literally every guiding structure that employees in normal jobs rely on.

In short, you must become an Unprompted Learner. You must become the type of person who is willing to set goals that don’t have an easy, straightforward path – and you have to be willing to ask the questions and seek out the answers that will allow you to start uncovering the twisting, maze-like path that will hopefully get you to those goals.

Side note: Artists have to be like this too, especially if you want to create art outside of the traditional bounds. I often think of artists as very similar to entrepreneurs; both have to make their own way. I’m writing this because this very article idea was inspired by a chat I had with Mary Spender, who is both a musician and an entrepreneur.

This also relates to my tip about getting a lawyer and accountant; don’t just assume they’re too expensive and never ask anyone what they charge. Ask around; get quotes. You can always say no to a pitch.

On the other hand, if you don’t ask, you’ll never get an answer. Or, to put it in Stevie Wonder’s words:

“If you don’t ask, you don’t get.”

If you enjoyed this article, you may want to sign up to my newsletter for content creators (emails are pretty infrequent):